About Us

Our Story

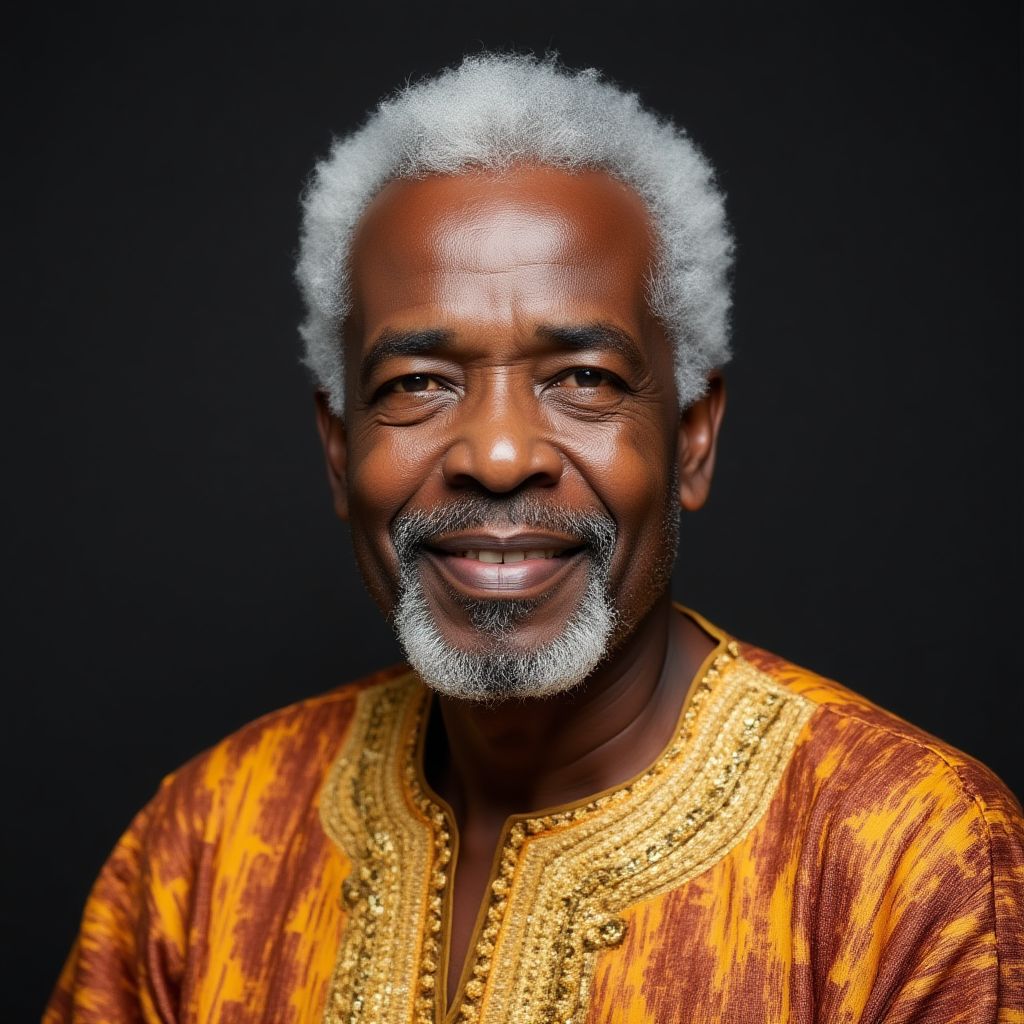

Hokisvaz was founded in 2012 by Dr. Emmanuel Koffi, a former banking executive who witnessed firsthand the devastating effects of financial illiteracy in Ghanaian communities. After 15 years in the banking sector, Dr. Koffi identified a critical gap in financial education that left many citizens vulnerable to predatory lending practices and unsustainable debt cycles.

What began as informal financial literacy workshops in community centers across Takoradi has evolved into Ghana's premier debt management and credit awareness training institution. In our first year, we trained just 120 individuals. Today, Hokisvaz serves over 5,000 clients annually through our comprehensive programs.

Our growth milestone came in 2015 when we partnered with the Bank of Ghana's Financial Literacy Initiative, allowing us to expand our curriculum and reach. In 2018, we moved to our current training facility on Chapel Hill Road, equipped with modern classrooms and simulation spaces for practical learning experiences.

Through economic fluctuations and challenges, we've maintained our commitment to accessible financial education for all Ghanaians. Our name "Hokisvaz" combines words from the Ewe language meaning "freedom from burden" – reflecting our mission to liberate individuals from financial stress through education and practical guidance.

Our Mission & Values

Mission

To empower Ghanaian individuals and businesses with practical financial knowledge and skills that lead to sustainable debt management, improved credit accessibility, and long-term financial well-being.

Core Values

-

Accessibility

We believe financial education should be available to everyone, regardless of economic status. We offer scholarship programs and sliding-scale fees to ensure our services reach those who need them most.

-

Practical Application

Our approach emphasizes real-world application over theoretical concepts. All training includes hands-on exercises that participants can immediately apply to their personal finances.

-

Cultural Relevance

We develop curriculum specifically for the Ghanaian context, incorporating local financial practices, institutions, and challenges that participants encounter daily.

-

Continuous Improvement

We continuously refine our programs based on participant feedback and changing financial landscapes to ensure our training remains effective and relevant.

Meet Our Team

Our diverse team of financial education specialists brings together expertise from banking, education, and community development to create impactful training experiences.

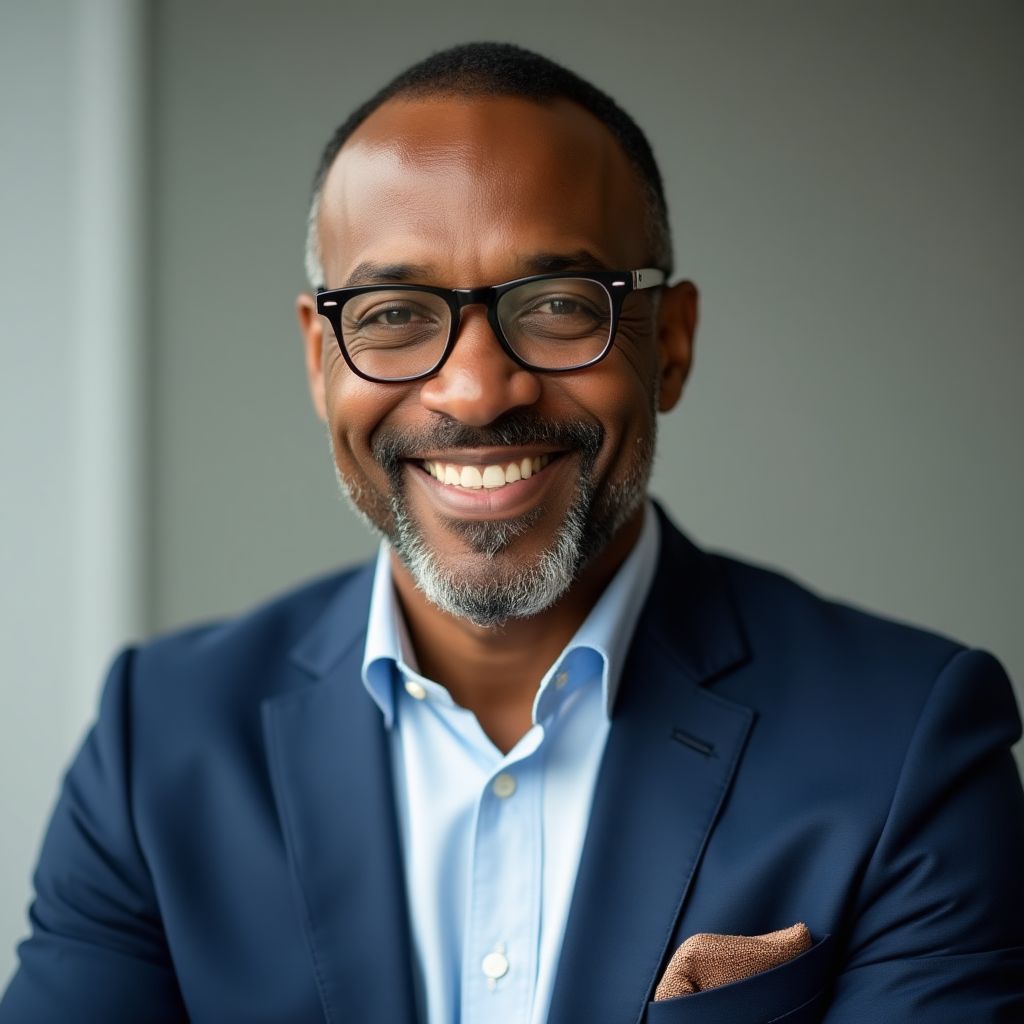

Dr. Emmanuel Koffi

Founder & Managing Director

With over 20 years of experience in the banking sector and a PhD in Financial Economics from the University of Ghana, Dr. Koffi oversees curriculum development and strategic partnerships. His research on microfinance practices in West African communities has been published internationally.

Abena Mensah

Lead Training Facilitator

Abena brings 12 years of experience as a former credit analyst and financial advisor. She specializes in translating complex financial concepts into accessible learning experiences. Her interactive teaching methods have become a hallmark of our debt management workshops.

Kwame Darko

Credit Education Specialist

Kwame previously worked at Ghana's Credit Bureau Association before joining Hokisvaz in 2016. He developed our credit score improvement program and maintains relationships with financial institutions to ensure our curriculum reflects current credit reporting practices.

Gifty Addo

Community Outreach Coordinator

With a background in social work and community development, Gifty leads our outreach programs that bring financial education to rural communities. She has established partnerships with 23 community organizations throughout Western Ghana to expand our reach.

Our Achievements

Since our founding, Hokisvaz has made significant contributions to financial literacy in Ghana:

25,000+ Individuals Trained

We've provided comprehensive financial education to over 25,000 individuals across all demographics, from students to retirees, helping them take control of their financial futures.

$4.2M in Debt Successfully Managed

Our clients have collectively restructured and managed over $4.2 million in debt through the strategies learned in our programs, leading to improved financial stability.

42 Community Partnerships

We've established partnerships with 42 community organizations, local governments, and financial institutions to expand access to financial education throughout Ghana.

Financial Education Excellence Award

Recognized by the Ghana Banking Association for excellence in financial education in 2019, highlighting our commitment to quality training and measurable outcomes.

What Our Clients Say

"Hokisvaz transformed my financial situation completely. I was drowning in debt from multiple loans with no clear strategy to repay them. Through their debt management program, I learned to prioritize high-interest debts, negotiate with creditors, and create a sustainable budget. Two years later, I've eliminated 70% of my debt and established an emergency fund. The practical skills I gained have changed not just my finances but my entire outlook on money."

"As a teacher with a modest income, I always thought improving my credit score was beyond my reach. Hokisvaz's credit awareness workshop showed me simple, practical steps that made an enormous difference. Their trainers explained complex concepts in ways that made sense, and the follow-up support was invaluable. Within six months, my improved score helped me secure financing for my children's education at a rate I could actually afford. I recommend their workshops to everyone."

"Our community savings group invited Hokisvaz to conduct a workshop on understanding interest rates and loan agreements. Their facilitator broke down the mathematics of compound interest in a way that everyone—regardless of education level—could understand. This knowledge helped our group avoid a predatory lending scheme and instead establish a relationship with a reputable microfinance institution. The practical exercises and role-playing scenarios were especially helpful for building confidence in financial negotiations."

Glimpses of Hokisvaz

Ready to Take Control of Your Financial Future?

Join thousands of individuals and businesses who have transformed their relationship with debt and credit through our specialized training programs.